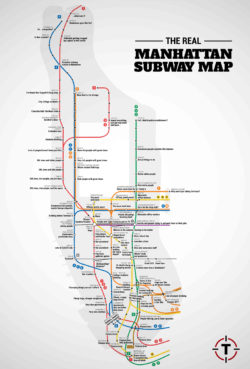

Finding a place to buy was no easy task. When I first became interested in becoming a homeowner, I subscribed to major real estate brokers’ email alerts, blogs, and newsletters. I perused listings like a madman. Bankrate.com become the first site I visited every morning. I spent many Saturdays attending open houses, even waiting on lines (I stood on line for 3 hours once) for high-demand listings.

Like many New Yorkers, I became discouraged and frustrated. I lowered my expectations and whittled down my must-have list many times. I cried.

During this time, the NYTimes’ weekly column, The Hunt, became a favorite read. Featuring real-life buyers, the budgets spanned anywhere from sub-$200k to millions. I found comfort in the fact that even millionaires suffered at the hands of NYC real estate.

I still read The Hunt for fun. I sympathize with those whose budgets are similar to mine, struggling to find a place to call home in the nation’s most expensive real estate market. I laugh at those with sky-high budgets, whining about the lack of amenities in multimillion-dollar listings.

Then there are times when I can’t decide whether to laugh or cry. Like yesterday’s The Hunt, when a wealthy divorcee downgrades from a 7,000 sqft mansion in Long Island to a 2 bdrm rental on the Upper West Side. A $6,495/month rental.

Here’s the kicker: her budget was $5,200.

Now, this woman may be able to afford the $1,300 extra a month with no problems. However, considering the current economic situation, I have to wonder what Joyce Cohen (the writer for The Hunt) was smoking when preparing this article. Because over-extending one’s budget had nothing to do with the financial crisis at all.

I like books, gadgets, spicy food, and art. I dislike shopping, hot weather, and the laws of entropy. Although I am a self-proclaimed computer nerd, I still have a love for handbags and makeup... and I am always teetering on high heels. To learn more about me, visit the

I like books, gadgets, spicy food, and art. I dislike shopping, hot weather, and the laws of entropy. Although I am a self-proclaimed computer nerd, I still have a love for handbags and makeup... and I am always teetering on high heels. To learn more about me, visit the